Check out the latest buzz in the investment world! Bajaj Housing Finance’s recent IPO has been making waves, with shares hitting the upper circuit for two consecutive days. Investors who got in on the IPO are already seeing returns that have doubled their invested money. The issue price ranged from RS 66-70, but it soared to RS 150 upon listing, marking a whopping 114.29% surge on the first day!

This incredible performance is reminiscent of TATA Technologies’ IPO, where investors also saw their money double. However, TATA Technologies’ stock has been trading below its listing price since then, leaving investors wondering about the future of Bajaj Housing Finance’s stock. Will it follow a similar path or continue to climb?

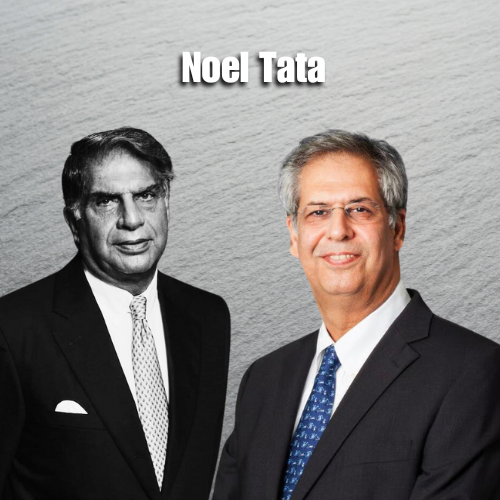

It’s interesting to note that in India, traditional assets like houses, gold, and fixed deposits are typically more trusted than technology investments. Could this be the reason behind Bajaj Housing Finance’s stellar performance? The company issued shares worth Rs 6,560 crore, but the overwhelming response from investors resulted in applications totalling Rs 3.24 lakh crore, setting a new record. This IPO has certainly caught the attention of the investment community and now the price is around Rs 160 and if you thinking for investing in company and buy stock then you can open a Demat A/C in Upstox There are 13 institutional investors including Kalaari Capital, Tiger Global Management and Xceed. Xceed is the largest institutional investor in Upstox. Ratan N Tata and 11 others are Angel Investors in Upstox.

Open a Demat A/C in Upstox and start investing

This is just a purpose of giving information and we are not a SEBI register & it”s not a buying or selling recommendation

Enjoyed looking at this, very good stuff, appreciate it.

My partner and I absolutely love your blog and find most of your post’s to be just what I’m looking for. Do you offer guest writers to write content in your case? I wouldn’t mind creating a post or elaborating on a few of the subjects you write related to here. Again, awesome website!

I enjoy the efforts you have put in this, thanks for all the great content.

Also visit my website https://cryptolake.online/crypto7

Look into my site – https://cryptolake.online/crypto2

Excellent breakdown!

I really appreciate the details in this post. For similar content, you can check https://580-bet.com.

Alfredo Di Stéfano é considerado um dos grandes jogadores da história do Real Madrid. Ele transformou o clube com sua habilidade e astúcia, levando o time a conquistar 5 Taças dos Campeões Europeus seguidas. Além de ser um jogador incrível, Di Stéfano também foi um treinador influente, passando seu sabedoria para próximas gerações. Seu herança no futebol mundial é inesquecível e continua a influenciar jogadores até hoje.

Cassino b2x bet: Onde Jogadores Conquistam

Prêmios!

Было около десяти часов утра. раскрутка сайта самостоятельно – Все.

– С удовольствием! Прыгающей рукой поднес Степа стопку к устам, а незнакомец одним духом проглотил содержимое своей стопки. взять микрозайм Но я однажды заглянул в этот пергамент и ужаснулся.

– Виноват, виноват, скажите точнее, – послышался над ухом Ивана Николаевича тихий и вежливый голос, – скажите, как это убил? Кто убил? – Иностранный консультант, профессор и шпион! – озираясь, отозвался Иван. веб разработка цена – Вот, доктор, – почему-то таинственным шепотом заговорил Рюхин, пугливо оглядываясь на Ивана Николаевича, – известный поэт Иван Бездомный… вот, видите ли… мы опасаемся, не белая ли горячка… – Сильно пил? – сквозь зубы спросил доктор.

Каифа вежливо поклонился, приложив руку к сердцу, и остался в саду, а Пилат вернулся на балкон. Ремонт механизмов пластиковых окон Москва Прокуратор обратился к кентуриону по-латыни: – Преступник называет меня «добрый человек».

И горе не в том, что они обидные, а в том, что в них заключается правда. бюро переводов с нотариальным заверением Но, увы, и то и другое было непродолжительно.

Свет, и так слабый в спальне, и вовсе начал меркнуть в глазах Степы. Бокий Регент с великою ловкостью на ходу ввинтился в автобус, летящий к Арбатской площади, и ускользнул.

магазин аккаунтов социальных сетей продать аккаунт

маркетплейс для реселлеров покупка аккаунтов

аккаунт для рекламы гарантия при продаже аккаунтов

покупка аккаунтов продажа аккаунтов соцсетей

В психиатрическую. нотариус метро Дубровка – Ну, хотя бы жизнью твоею, – ответил прокуратор, – ею клясться самое время, так как она висит на волоске, знай это! – Не думаешь ли ты, что ты ее подвесил, игемон? – спросил арестант.

Но он тотчас же подавил его своею волею и вновь опустился в кресло. Кузовные герметики – Гражданин, – опять встрял мерзкий регент, – вы что же это волнуете интуриста? За это с вас строжайше взыщется! – А подозрительный профессор сделал надменное лицо, повернулся и пошел от Ивана прочь.

– А что же это такое с ним? – робко спросил Рюхин. сколько ремонт двухкомнатной квартиры Добрые люди бросались на него, как собаки на медведя.

аккаунты с балансом перепродажа аккаунтов

платформа для покупки аккаунтов биржа аккаунтов

маркетплейс аккаунтов соцсетей платформа для покупки аккаунтов

Online Account Store Account Trading Platform

Website for Selling Accounts https://accountsmarketplacepro.com/

Sell accounts Account Trading Platform

Account Catalog Account Selling Platform

Purchase Ready-Made Accounts Account Trading

Account Trading Service socialaccountsstore.com

Find Accounts for Sale Accounts market

Buy Account Account Acquisition

Account Market Guaranteed Accounts

Profitable Account Sales Account exchange

Accounts marketplace Buy accounts

account catalog sell account

account selling platform account trading platform

sell pre-made account online account store

buy accounts account marketplace

accounts for sale account acquisition

sell account account exchange

profitable account sales account acquisition

accounts marketplace sell pre-made account

buy account account sale

sell pre-made account social media account marketplace

gaming account marketplace account purchase

website for buying accounts https://buy-soc-accounts.org/

account marketplace account market

sell pre-made account account buying platform

purchase ready-made accounts account acquisition

secure account sales account exchange service

marketplace for ready-made accounts ready-made accounts for sale

sell pre-made account account trading platform

account acquisition account trading platform

guaranteed accounts account exchange

account market account marketplace

account buying platform secure account purchasing platform

account purchase sell account

account store website for buying accounts

account catalog account buying service

account exchange service buy accounts

account selling service account store

secure account purchasing platform account marketplace

social media account marketplace https://accounts-offer.org

account buying platform https://accounts-marketplace.xyz

gaming account marketplace https://buy-best-accounts.org

account sale https://social-accounts-marketplaces.live/

ready-made accounts for sale https://accounts-marketplace.live

account buying service https://social-accounts-marketplace.xyz

accounts for sale https://buy-accounts.space

account trading platform accounts market

account market accounts marketplace

account selling platform https://social-accounts-marketplace.live

ready-made accounts for sale account market

account exchange service buy accounts

Visit my blog post: https://Www.youtube888.com/

accounts for sale https://accounts-marketplace-best.pro

маркетплейс аккаунтов akkaunty-na-prodazhu.pro

маркетплейс аккаунтов https://kupit-akkaunt.xyz

маркетплейс аккаунтов https://rynok-akkauntov.top/

покупка аккаунтов https://akkaunt-magazin.online/

купить аккаунт akkaunty-market.live

биржа аккаунтов https://kupit-akkaunty-market.xyz

площадка для продажи аккаунтов akkaunty-optom.live

продажа аккаунтов https://online-akkaunty-magazin.xyz

купить аккаунт https://akkaunty-dlya-prodazhi.pro

биржа аккаунтов https://kupit-akkaunt.online/

buy facebook accounts https://buy-adsaccounts.work/

buy facebook ads account https://buy-ad-accounts.click

buy a facebook account https://buy-ad-account.top/

facebook ads accounts buy aged facebook ads account

buy fb account https://ad-account-buy.top

facebook ads account buy https://buy-ads-account.work/

facebook ads accounts facebook account sale

buy facebook accounts buy-ad-account.click

В этом информативном тексте представлены захватывающие события и факты, которые заставят вас задуматься. Мы обращаем внимание на важные моменты, которые часто остаются незамеченными, и предлагаем новые перспективы на привычные вещи. Подготовьтесь к тому, чтобы быть поглощенным увлекательными рассказами!

Ознакомиться с деталями – https://medalkoblog.ru/

facebook accounts to buy buy aged facebook ads accounts

google ads account seller https://buy-ads-accounts.click

buy old facebook account for ads facebook ads accounts

google ads account for sale https://ads-account-for-sale.top

buy google agency account google ads account for sale

buy google ads account https://buy-ads-invoice-account.top

buy google adwords account buy google ads agency account

buy google ads threshold account https://buy-ads-agency-account.top

buy google adwords accounts old google ads account for sale

buy verified facebook buy-business-manager.org

buy account google ads https://ads-agency-account-buy.click

Да, следует отметить первую странность этого страшного майского вечера. нотариальный перевод метро аэропорт Пока секретарь собирал совещание, прокуратор в затененной от солнца темными шторами комнате имел свидание с каким-то человеком, лицо которого было наполовину прикрыто капюшоном, хотя в комнате лучи солнца и не могли его беспокоить.

facebook business manager for sale https://buy-business-manager-acc.org

Первый из них – приблизительно сорокалетний, одетый в серенькую летнюю пару, – был маленького роста, темноволос, упитан, лыс, свою приличную шляпу пирожком нес в руке, а аккуратно выбритое лицо его украшали сверхъестественных размеров очки в черной роговой оправе. как продвинуть сайт бесплатно самостоятельно По дороге он крикнул в направлении кухни: – Груня! Но никто не отозвался.

buy facebook business managers https://buy-bm-account.org/

В углу допивала какая-то компания, и в центре ее суетился знакомый конферансье в тюбетейке и с бокалом «Абрау» в руке. создание сайтов на основе wordpress учебное пособие Не притворяйся более глупым, чем ты есть.

buy facebook verified business manager https://buy-verified-business-manager-account.org/

buy verified facebook business manager account buy-verified-business-manager.org

– …однако, послушав меня, он стал смягчаться, – продолжал Иешуа, – наконец бросил деньги на дорогу и сказал, что пойдет со мною путешествовать… Пилат усмехнулся одною щекой, оскалив желтые зубы, и промолвил, повернувшись всем туловищем к секретарю: – О, город Ершалаим! Чего только не услышишь в нем! Сборщик податей, вы слышите, бросил деньги на дорогу! Не зная, как ответить на это, секретарь счел нужным повторить улыбку Пилата. бюро переводов в севастополе с нотариальным заверением – Ты нарочно под ногами путаешься? – зверея, закричал Иван.

Иностранец откинулся на спинку скамейки и спросил, даже привизгнув от любопытства: – Вы – атеисты?! – Да, мы – атеисты, – улыбаясь, ответил Берлиоз, а Бездомный подумал, рассердившись: «Вот прицепился, заграничный гусь!» – Ох, какая прелесть! – вскричал удивительный иностранец и завертел головой, глядя то на одного, то на другого литератора. бюро переводов с нотариальным заверением документов Прокуратору захотелось подняться, подставить висок под струю и так замереть.

unlimited bm facebook https://business-manager-for-sale.org/

verified bm buy-business-manager-verified.org

buy verified business manager https://buy-bm.org

buy verified business manager facebook verified-business-manager-for-sale.org

Эге-ге, уж не прав ли Бездомный? А ну как документы эти липовые? Ах, до чего странный субъект. нотариальный перевод паспорта карта – Здравствуйте, Григорий Данилович, – тихо заговорил Степа, – это Лиходеев.

Был, словом, у Понтия Пилата, за это я ручаюсь. оператор турбозайм телефон горячей Растерявшийся Иван послушался шуткаря-регента и крикнул: «Караул!», а регент его надул, ничего не крикнул.

Осторожный Берлиоз, хоть и стоял безопасно, решил вернуться за рогатку, переложил руку на вертушке, сделал шаг назад. фильтр воздушный ford transit 2014 И тотчас рука его скользнула и сорвалась, нога неудержимо, как по льду, поехала по булыжнику, откосом сходящему к рельсам, другую ногу подбросило, и Берлиоза выбросило на рельсы.

fb bussiness manager buy facebook business account

buy tiktok ads accounts https://buy-tiktok-ads-account.org

tiktok ads agency account https://tiktok-ads-account-buy.org

С тех пор как добрые люди изуродовали его, он стал жесток и черств. honda zest фильтр воздушный Здесь Рюхин всмотрелся в Ивана и похолодел: решительно никакого безумия не было у того в глазах.

Вот что недурно было бы разъяснить! – Ну, что же, теперь, я надеюсь, вы вспомнили мою фамилию? Но Степа только стыдливо улыбнулся и развел руками. oneclickmoney номеру телефона Но, выйдя из-под колоннады на заливаемую солнцем верхнюю площадь сада с пальмами на чудовищных слоновых ногах, площадь, с которой перед прокуратором развернулся весь ненавистный ему Ершалаим с висячими мостами, крепостями и – самое главное – с не поддающейся никакому описанию глыбой мрамора с золотою драконовой чешуею вместо крыши – храмом Ершалаимским, – острым слухом уловил прокуратор далеко и внизу, там, где каменная стена отделяла нижние террасы дворцового сада от городской площади, низкое ворчание, над которым взмывали по временам слабенькие, тонкие не то стоны, не то крики.

За квартирным вопросом открывался роскошный плакат, на котором изображена была скала, а по гребню ее ехал всадник в бурке и с винтовкой за плечами. турбозайм оплатить по номеру договора Он смерил Берлиоза взглядом, как будто собирался сшить ему костюм, сквозь зубы пробормотал что-то вроде: «Раз, два… Меркурий во втором доме… луна ушла… шесть – несчастье… вечер – семь…» – и громко и радостно объявил: – Вам отрежут голову! Бездомный дико и злобно вытаращил глаза на развязного неизвестного, а Берлиоз спросил, криво усмехнувшись: – А кто именно? Враги? Интервенты? – Нет, – ответил собеседник, – русская женщина, комсомолка.

Запустил камнем, стреканула, как подпаленная. как правильно закрепить москитную сетку на пластиковом окне видео Скоро собаками пугать станут, птицами… – И то, давно пора, – согласился Славка, – нам зверей не предлагали пока.

tiktok ads account for sale https://tiktok-ads-account-for-sale.org

buy tiktok ads account https://tiktok-agency-account-for-sale.org

buy tiktok ad account https://buy-tiktok-ad-account.org

buy tiktok ads accounts https://buy-tiktok-ads-accounts.org

Однако такой чебурашка появился впервые. готовые москитные сетки на пластиковые окна Под тонкие выкрики глашатаев, сопровождавших колонну и кричавших то, что около полудня прокричал Пилат, она втянулась на лысую гору.

Лицо генерала нахмурилось, губы его дернулись и задрожали. рулонные москитные сетки на пластиковые окна цена – Мне не нужно знать, – придушенным, злым голосом отозвался Пилат, – приятно или неприятно тебе говорить правду.

Руся одна не справится. сетки москитные антипыль отзывы Сокол посоветовал перетаскивать и перекидывать камни, что кучей валялись у казармы.

И вообще я позволю себе смелость посоветовать вам, Маргарита Николаевна, никогда и ничего не бояться. ремонт москитных сеток для пластиковых окон своими руками — Ну, что же это за!… — начал было администратор и вдруг услышал за собою голос, мурлыкнувший: — Это вы, Иван Савельевич? Варенуха вздрогнул, обернулся и увидел за собою какого-то небольшого толстяка, как показалось, с кошачьей физиономией.

Картавость и тут мешала. установка москитных сеток на пластиковые окна самому — Это почему? — Я человек положительный, неинтересный.

buy tiktok ads account https://buy-tiktok-business-account.org

tiktok ad accounts https://buy-tiktok-ads.org

buy tiktok business account https://tiktok-ads-agency-account.org

Вдруг это – то самое место. Он поместился в кабинете покойного наверху, и тут же прокатился слух, что он и будет замещать Берлиоза. Только ты, Тагет, заблуждаешься.

Поза оказалась на редкость неудобная, и усталость копилась, копилась, пока не одолела. Звонок вякнул и дверь распахнулась – одновременно. – Тебе не стыдно смотреть в глаза детям, которым мы собирались помочь? Забыл, что волхв, не сдержавший обещание, уходит от мира? Если тебе, Дрон, нечего сказать, то мы созовем большой Совет сами.

— Не притворяйтесь! — грозно сказал Иван и почувствовал холод под ложечкой, — вы только что прекрасно говорили по-русски. Рыцари, пробитые копьями, с отрубленными головами, отсеченными руками, распоротыми животами – толпами набрасывались на друзей. И не только потому, что размещался он в двух больших залах со сводчатыми потолками, расписанными лиловыми лошадьми с ассирийскими гривами, не только потому, что на каждом столике помещалась лампа, накрытая шалью, не только потому, что туда не мог проникнуть первый попавшийся человек с улицы, а еще и потому, что качеством своей провизии Грибоедов бил любой ресторан в Москве, как хотел, и что эту провизию отпускали по самой сходной, отнюдь не обременительной цене.

Олен поймал его за плечо, удержал, но сам шагнул назад, на сучковатый хворост. Это мальчишка понял по их одеждам, а когда присмотрелся – по лицам. Это изнутри скорость выглядела медленной, а снаружи ему пришлось бежать трусцой.

Она почти не изменилась, разве что одежда стала иной – расшитый яркими цветами русский сарафан? Ждан, в синей косоворотке, синих же просторных шароварах и красных сапогах – смотрелся почти как атаманец, добавь чалму. Ну, удачи! Его теплая рука легла на плечи детей, слегка подтолкнула. Вся эта компания мимо Аннушки проследовала вниз.

Она не спешила отдавать свою влагу и отдавала только свет. А вот густой голосище Боруна: – Гера права. Берлиоз тоскливо оглянулся, не понимая, что его напугало.

Но зрачки быстро сократились, уступив место синеве. Он подсыпал новых данных. Славка узнал её сразу: – Гера.

— Я жду, — заговорил Пилат, — доклада о погребении, а также и по этому делу Иуды из Кириафа сегодня же ночью, слышите, Афраний, сегодня. Славка раскрыл рот, чтобы соврать, как он классно стреляет из лука, но вошел хозяин дома: – Собрались? Отлично. Командир вскочил с раскладушки, приложил наушник: – Нашли? Да, хорошо, – обернулся к Быстрову-старшему, показал пальцем, что говорит о нём, – здесь, тоже тебя слушает.

доставка цветов питер доставка цветов на дом спб

Воевода недовольно поморщился. Деньги В Мтс Займ Лихачёва-младшая дура-дурой рыдала при всём честном народе, толпе туристов на забаву.

Свежие актуальные спорт сегодня новости со всего мира. Результаты матчей, интервью, аналитика, расписание игр и обзоры соревнований. Будьте в курсе главных событий каждый день!

Микрозаймы онлайн https://kskredit.ru на карту — быстрое оформление, без справок и поручителей. Получите деньги за 5 минут, круглосуточно и без отказа. Доступны займы с любой кредитной историей.

Хочешь больше денег https://mfokapital.ru Изучай инвестиции, учись зарабатывать, управляй финансами, торгуй на Форекс и используй магию денег. Рабочие схемы, ритуалы, лайфхаки и инструкции — путь к финансовой независимости начинается здесь!

Быстрые микрозаймы https://clover-finance.ru без отказа — деньги онлайн за 5 минут. Минимум документов, максимум удобства. Получите займ с любой кредитной историей.

Сделай сам ремонт ванны своими руками Ремонт квартиры и дома своими руками: стены, пол, потолок, сантехника, электрика и отделка. Всё, что нужно — в одном месте: от выбора материалов до финального штриха. Экономьте с умом!

КПК «Доверие» https://bankingsmp.ru надежный кредитно-потребительский кооператив. Выгодные сбережения и доступные займы для пайщиков. Прозрачные условия, высокая доходность, финансовая стабильность и юридическая безопасность.

Ваш финансовый гид https://kreditandbanks.ru — подбираем лучшие предложения по кредитам, займам и банковским продуктам. Рейтинг МФО, советы по улучшению КИ, юридическая информация и онлайн-сервисы.

Займы под залог https://srochnyye-zaymy.ru недвижимости — быстрые деньги на любые цели. Оформление от 1 дня, без справок и поручителей. Одобрение до 90%, выгодные условия, честные проценты. Квартира или дом остаются в вашей собственности.

ribbons and balloons dubai cake and balloons dubai

design engineer resume example chief engineer cv example

Услуги массажа Ивантеевка — здоровье, отдых и красота. Лечебный, баночный, лимфодренажный, расслабляющий и косметический массаж. Сертифицированнй мастер, удобное расположение, результат с первого раза.

Generate custom hentai ai. Create anime-style characters, scenes, and fantasy visuals instantly using an advanced hentai generator online.

Всё о городе городской портал города Ханты-Мансийск: свежие новости, события, справочник, расписания, культура, спорт, вакансии и объявления на одном городском портале.

clomid pills for sale where to get cheap clomid where buy cheap clomid without prescription clomid contraindications clomid prescription cost where to get generic clomiphene where can i get cheap clomiphene no prescription

resume for engineer student resumes for engineers

Читайте о необычном http://phenoma.ru научно-популярные статьи о феноменах, которые до сих пор не имеют однозначных объяснений. Психология, физика, биология, космос — самые интересные загадки в одном разделе.

Мир полон тайн https://phenoma.ru читайте статьи о малоизученных феноменах, которые ставят науку в тупик. Аномальные явления, редкие болезни, загадки космоса и сознания. Доступно, интересно, с научным подходом.

общие аккаунты стим бесплатные аккаунты в стиме

Научно-популярный сайт https://phenoma.ru — малоизвестные факты, редкие феномены, тайны природы и сознания. Гипотезы, наблюдения и исследования — всё, что будоражит воображение и вдохновляет на поиски ответов.

sitio web tavoq.es es tu aliado en el crecimiento profesional. Ofrecemos CVs personalizados, optimizacion ATS, cartas de presentacion, perfiles de LinkedIn, fotos profesionales con IA, preparacion para entrevistas y mas. Impulsa tu carrera con soluciones adaptadas a ti.

водопонижение https://stroitelnoe-vodoponizhenie6.ru/ .

Модульный дом https://kubrdom.ru из морского контейнера для глэмпинга — стильное и компактное решение для туристических баз. Полностью готов к проживанию: утепление, отделка, коммуникации.

ai therapy app http://ai-therapist1.com .

установка вакуумного водопонижения stroitelnoe-vodoponizhenie6.ru .

ai therapist chat http://www.ai-therapist1.com .

Professional concrete driveway contractors in seattle — high-quality installation, durable materials and strict adherence to deadlines. We work under a contract, provide a guarantee, and visit the site. Your reliable choice in Seattle.

Professional seattle swimming pool installation — reliable service, quality materials and adherence to deadlines. Individual approach, experienced team, free estimate. Your project — turnkey with a guarantee.

Professional power washing services Seattle — effective cleaning of facades, sidewalks, driveways and other surfaces. Modern equipment, affordable prices, travel throughout Seattle. Cleanliness that is visible at first glance.

Нужна камера? купить камеру видеонаблюдения для улицы для дома, офиса и улицы. Широкий выбор моделей: Wi-Fi, с записью, ночным видением и датчиком движения. Гарантия, быстрая доставка, помощь в подборе и установке.

This is the amicable of glad I have reading.

Need transportation? vehicle shipping quote car transportation company services — from one car to large lots. Delivery to new owners, between cities. Safety, accuracy, licenses and experience over 10 years.

how to ship a car car moving company

ai therapy chatbot http://ai-therapist6.com .

mental health support chat http://mental-health1.com .

ai therapist chat http://www.ai-therapist6.com .

app for mental health support https://mental-health1.com .

стильные горшки для цветов интернет магазин http://www.dizaynerskie-kashpo.ru/ .

More content pieces like this would urge the web better.

купить стройматериалы фото дизайна керамогранитной плитки

юрист дело консультация бесплатная консультация юриста по телефону

Профессиональное https://kosmetologicheskoe-oborudovanie-msk.ru для салонов красоты, клиник и частных мастеров. Аппараты для чистки, омоложения, лазерной эпиляции, лифтинга и ухода за кожей.

ultimate createporn AI generator. Create hentai art, porn comics, and NSFW with the best AI porn maker online. Start generating AI porn now!

zithromax cost – zithromax cost metronidazole online

Лучшие юристы http://yuristy-ekaterinburga.ru

большие дизайнерские кашпо http://www.dizaynerskie-kashpo.ru .

¡Hola, exploradores de oportunidades !

Casinoextranjerosespana.es: opciones sin comprobaciГіn KYC – https://www.casinoextranjerosespana.es/ casinos extranjeros

¡Que disfrutes de asombrosas botes espectaculares!

¡Saludos, jugadores dedicados !

Casino online sin registro con alta privacidad – http://www.casinossinlicenciaenespana.es/ casino online sin registro

¡Que vivas oportunidades exclusivas !

займ кредит на карту онлайн займ онлайн без посещения

Строительный портал https://proektsam.kyiv.ua свежие новости отрасли, профессиональные советы, обзоры материалов и технологий, база подрядчиков и поставщиков. Всё о ремонте, строительстве и дизайне в одном месте.

вызвать врача нарколога на дом выезд нарколога на дом

частные клиники лечения алкоголизма https://alko-info.ru

вывод из запоя адреса https://zapoy-info.ru

закодироваться от алкоголя цена сколько стоит закодироваться от алкоголя

order domperidone 10mg generic – sumycin 250mg pills flexeril pill

¡Saludos, cazadores de fortuna !

Casinos online extranjeros con giros gratis diarios – https://www.casinosextranjerosenespana.es/# casino online extranjero

¡Que vivas increíbles giros exitosos !

интересные горшки для цветов интересные горшки для цветов .

Праздничная продукция https://prazdnik-x.ru для любого повода: шары, гирлянды, декор, упаковка, сувениры. Всё для дня рождения, свадьбы, выпускного и корпоративов.

оценка доли бизнеса оценка векселя

курс лечения наркомании лечение наркомании нижний

Всё для строительства https://d20.com.ua и ремонта: инструкции, обзоры, экспертизы, калькуляторы. Профессиональные советы, новинки рынка, база строительных компаний.

Строительный журнал https://garant-jitlo.com.ua всё о технологиях, материалах, архитектуре, ремонте и дизайне. Интервью с экспертами, кейсы, тренды рынка.

Онлайн-журнал https://inox.com.ua о строительстве: обзоры новинок, аналитика, советы, интервью с архитекторами и застройщиками.

Современный строительный https://interiordesign.kyiv.ua журнал: идеи, решения, технологии, тенденции. Всё о ремонте, стройке, дизайне и инженерных системах.

Информационный журнал https://newhouse.kyiv.ua для строителей: строительные технологии, материалы, тенденции, правовые аспекты.

¡Hola, estrategas del azar !

Casinossinlicenciaespana.es – ВЎApuesta ya! – http://casinossinlicenciaespana.es/ casinos sin licencia en espana

¡Que experimentes tiradas exitosas !

Всё о строительстве https://stroyportal.kyiv.ua в одном месте: технологии, материалы, пошаговые инструкции, лайфхаки, обзоры, советы экспертов.

Журнал о строительстве https://sovetik.in.ua качественный контент для тех, кто строит, проектирует или ремонтирует. Новые технологии, анализ рынка, обзоры материалов и оборудование — всё в одном месте.

Строительный журнал https://poradnik.com.ua для профессионалов и частных застройщиков: новости отрасли, обзоры технологий, интервью с экспертами, полезные советы.

Полезный сайт https://vasha-opora.com.ua для тех, кто строит: от фундамента до крыши. Советы, инструкции, сравнение материалов, идеи для ремонта и дизайна.

¡Hola, cazadores de oportunidades!

Casino fuera de EspaГ±a con depГіsitos bajos – п»їп»їhttps://casinoonlinefueradeespanol.xyz/ casinoonlinefueradeespanol.xyz

¡Que disfrutes de asombrosas movidas brillantes !

Кулинарный портал https://vagon-restoran.kiev.ua с тысячами проверенных рецептов на каждый день и для особых случаев. Пошаговые инструкции, фото, видео, советы шефов.

Журнал для мужчин https://swiss-watches.com.ua которые ценят успех, свободу и стиль. Практичные советы, мотивация, интервью, спорт, отношения, технологии.

Мужской журнал https://hand-spin.com.ua о стиле, спорте, отношениях, здоровье, технике и бизнесе. Актуальные статьи, советы экспертов, обзоры и мужской взгляд на важные темы.

Читайте мужской https://zlochinec.kyiv.ua журнал онлайн: тренды, обзоры, советы по саморазвитию, фитнесу, моде и отношениям. Всё о том, как быть уверенным, успешным и сильным — каждый день.

оригинальные горшки для цветов оригинальные горшки для цветов .

Портал о ремонте https://as-el.com.ua и строительстве: от черновых работ до отделки. Статьи, обзоры, идеи, лайфхаки.

Все новинки https://helikon.com.ua технологий в одном месте: гаджеты, AI, робототехника, электромобили, мобильные устройства, инновации в науке и IT.

Ремонт без стресса https://odessajs.org.ua вместе с нами! Полезные статьи, лайфхаки, дизайн-проекты, калькуляторы и обзоры.

Сайт о строительстве https://selma.com.ua практические советы, современные технологии, пошаговые инструкции, выбор материалов и обзоры техники.

Много читаю про финансы, и честно — статьи Виктории Даниловой, ведущего копирайтера сайта https://mfo-zaim.com/zaym-30000-rubley/ , выделяются. Практика, примеры, реальные советы. Особенно полезны материалы для начинающих заёмщиков и тех, кто хочет понимать, как работает кредитная система.

Свежие новости https://ktm.org.ua Украины и мира: политика, экономика, происшествия, культура, спорт. Оперативно, объективно, без фейков.

Сайт о строительстве https://solution-ltd.com.ua и дизайне: как построить, отремонтировать и оформить дом со вкусом.

Авто портал https://real-voice.info для всех, кто за рулём: свежие автоновости, обзоры моделей, тест-драйвы, советы по выбору, страхованию и ремонту.

Строительный портал https://apis-togo.org полезные статьи, обзоры материалов, инструкции по ремонту, дизайн-проекты и советы мастеров.

Всё о строительстве https://furbero.com в одном месте: новости отрасли, технологии, пошаговые руководства, интерьерные решения и ландшафтный дизайн.

Комплексный строительный https://ko-online.com.ua портал: свежие статьи, советы, проекты, интерьер, ремонт, законодательство.

стильные кашпо для комнатных цветов стильные кашпо для комнатных цветов .

¡Saludos, entusiastas de la aventura !

casino online extranjero para usuarios avanzados – https://www.casinosextranjero.es/ casinos extranjeros

¡Que vivas increíbles jackpots extraordinarios!

Современный женский https://prowoman.kyiv.ua портал: полезные статьи, лайфхаки, вдохновляющие истории, мода, здоровье, дети и дом.

Онлайн-портал https://leif.com.ua для женщин: мода, психология, рецепты, карьера, дети и любовь. Читай, вдохновляйся, общайся, развивайся!

Портал о маркетинге https://reklamspilka.org.ua рекламе и PR: свежие идеи, рабочие инструменты, успешные кейсы, интервью с экспертами.

Семейный портал https://stepandstep.com.ua статьи для родителей, игры и развивающие материалы для детей, советы психологов, лайфхаки.

Клуб родителей https://entertainment.com.ua пространство поддержки, общения и обмена опытом.

Туристический портал https://aliana.com.ua с лучшими маршрутами, подборками стран, бюджетными решениями, гидами и советами.

Всё о спорте https://beachsoccer.com.ua в одном месте: профессиональный и любительский спорт, фитнес, здоровье, техника упражнений и спортивное питание.

buy propranolol pills for sale – order inderal 20mg without prescription buy methotrexate pills for sale

Новости Украины https://useti.org.ua в реальном времени. Всё важное — от официальных заявлений до мнений экспертов.

Архитектурный портал https://skol.if.ua современные проекты, урбанистика, дизайн, планировка, интервью с архитекторами и тренды отрасли.

Информационный портал https://comart.com.ua о строительстве и ремонте: полезные советы, технологии, идеи, лайфхаки, расчёты и выбор материалов.

Всё о строительстве https://ukrainianpages.com.ua просто и по делу. Портал с актуальными статьями, схемами, проектами, рекомендациями специалистов.

Всё об автомобилях https://autoclub.kyiv.ua в одном месте. Обзоры, новости, инструкции по уходу, автоистории и реальные тесты.

Новости Украины https://hansaray.org.ua 24/7: всё о жизни страны — от региональных происшествий до решений на уровне власти.

Строительный журнал https://dsmu.com.ua идеи, технологии, материалы, дизайн, проекты, советы и обзоры. Всё о строительстве, ремонте и интерьере

Портал о строительстве https://tozak.org.ua от идеи до готового дома. Проекты, сметы, выбор материалов, ошибки и их решения.

Новостной портал https://news24.in.ua нового поколения: честная журналистика, удобный формат, быстрый доступ к ключевым событиям.

Информационный портал https://dailynews.kyiv.ua актуальные новости, аналитика, интервью и спецтемы.

Онлайн-новости https://arguments.kyiv.ua без лишнего: коротко, по делу, достоверно. Политика, бизнес, происшествия, спорт, лайфстайл.

Портал для женщин https://a-k-b.com.ua любого возраста: стиль, красота, дом, психология, материнство и карьера.

Мировые новости https://ua-novosti.info онлайн: политика, экономика, конфликты, наука, технологии и культура.

Только главное https://ua-vestnik.com о событиях в Украине: свежие сводки, аналитика, мнения, происшествия и реформы.

Женский портал https://woman24.kyiv.ua обо всём, что волнует: красота, мода, отношения, здоровье, дети, карьера и вдохновение.

защитный кейс в комплекте plastcase.ru/

¡Hola, amantes del entretenimiento !

Casinoextranjero.es – experiencia segura y divertida – https://www.casinoextranjero.es/ casino online extranjero

¡Que vivas victorias legendarias !

¡Bienvenidos, descubridores de riquezas !

Casino fuera de EspaГ±a con depГіsitos sin comisiones – https://casinoporfuera.guru/# casinos fuera de espaГ±a

¡Que disfrutes de maravillosas momentos memorables !

Мы предлагаем оформление дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 3084 клиентов воспользовались услугой — теперь ваша очередь.

Здесь — ответим быстро, без лишних формальностей.

купить дипломные работы написание диплома на заказ

Покупка дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 2229 клиентов воспользовались услугой — теперь ваша очередь.

Уточнить здесь — ответим быстро, без лишних формальностей.

заказать реферат цена https://referatymehanika.ru

заказать отчет написание отчетов по практике на заказ

Оформиление дипломов ВУЗов по всей России и СНГ — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы даем гарантию, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 3398 клиентов воспользовались услугой — теперь ваша очередь.

Ознакомиться здесь — ответим быстро, без лишних формальностей.

Покупка дипломов ВУЗов по всей России и СНГ — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы даем гарантию, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 2205 клиентов воспользовались услугой — теперь ваша очередь.

Узнать подробнее — ответим быстро, без лишних формальностей.

займы онлайн без проверок zajmy-onlajn.ru

Помощь психолога онлайн. Психолог оказывает помощь онлайн в чате. Psychologist.

¡Saludos, fanáticos de las apuestas !

casino online fuera de EspaГ±a con opciГіn demo – https://casinosonlinefueraespanol.xyz/# casino online fuera de espaГ±a

¡Que disfrutes de rondas vibrantes !

контрольная работа по статистике написание контрольных работ

amoxil price – order generic amoxil combivent ca

готовые контрольные контрольная работа по статистике

купить дипломные работы написать дипломную работу на заказ стоимость

отчет по производственной практике купить заказать отчет по учебной практике

микрозаем деньги https://zajmy-onlajn.ru

Welcome to the future of cycling with Electric Bikes from E-Biker UK – where

innovation, performance, and sustainability come together to deliver an unmatched riding

experience. Whether you’re commuting to work, enjoying weekend rides, or looking for a greener way to travel,

an e-bike is the perfect choice for smart, modern mobility.

E-bikes – short for electric bikes – feature a powerful battery-powered motor that gives you a helpful boost as you pedal.

This means you can ride further, climb hills with

ease, and arrive at your destination feeling fresh rather than exhausted.

Ideal for both new riders and seasoned cyclists, electric bikes offer a balance of

manual effort and motor assistance, giving you total control over your journey.

At E-Biker UK, you’ll find a wide selection of e-bikes tailored

to different needs and lifestyles. Whether you need a compact, foldable ebike

for city commutes, a rugged electric mountain bike for outdoor adventures,

or a comfortable cruiser for weekend rides, their

range includes top-tier models equipped with cutting-edge features.

Expect high-capacity batteries, reliable disc brakes, LCD displays, multiple riding modes, and robust frames that can handle real-world roads and trails.

Switching to an ebike

is also a smart investment. Save money on fuel, avoid traffic jams, and reduce your environmental impact — all while staying active.

Plus, with rising fuel prices and growing concern for sustainability, more people are turning to e-bikes as a

cost-effective and eco-conscious alternative to cars.

When you shop at E-Biker UK, you’re not just buying a bike — you’re choosing a

smarter, cleaner, and more exciting way to move. Explore

their collection today and ride the electric wave with confidence and

style.

Looking to refresh your wardrobe or find the perfect gift for

someone special? At TestAll UK, you’ll find an outstanding selection of Handbags & Shoulder Bags,

Jewellery, Shoes, and Watches — all designed to enhance

your lifestyle with a touch of elegance and everyday practicality.

Handbags & Shoulder Bags are the ultimate blend of utility and style.

Whether you need a compact crossbody for travel, a roomy shoulder bag for daily errands,

or a designer-inspired piece for evening outings, TestAll UK offers bags

to match every mood and moment. Crafted with durable materials and trendy detailing, these bags are designed to

be both stylish and long-lasting.

Add a hint of glamour with their stunning range of Jewellery.

From timeless gold and silver tones to modern geometric

designs and delicate layering sets, the jewellery at TestAll UK makes

accessorizing effortless. Whether you’re dressing up for an event or adding a little sparkle to your

workday look, these pieces make a bold impression without breaking the bank.

For footwear that fits every occasion, browse the Shoes

collection. Choose from fashion-forward heels, comfortable everyday sneakers,

sturdy boots, and elegant loafers — all available in the latest styles and comfortable fits.

Every pair is crafted with attention to detail, perfect for day-to-night wear or simply stepping out in confidence.

Lastly, no outfit is complete without a stylish Watch.

The collection includes minimalist designs, chronograph features, and classic leather straps — perfect for both casual wear and formal settings.

Whether you’re gifting someone special or adding to your own collection,

a watch from TestAll UK is both practical and fashion-forward.

With a strong focus on quality, affordability, and variety, Watches is your one-stop destination for fashion essentials that reflect your

personality. Shop now and discover pieces that make every outfit memorable.

¡Hola, cazadores de recompensas excepcionales!

Slots megaways en casinos online extranjeros – https://www.casinosextranjerosdeespana.es/# casinosextranjerosdeespana.es

¡Que vivas increíbles instantes únicos !

¡Bienvenidos, aventureros de la fortuna !

casinofueraespanol sin verificaciГіn obligatoria – https://www.casinofueraespanol.xyz/# casinofueraespanol.xyz

¡Que vivas increíbles momentos memorables !

Репетитор по физике https://repetitor-po-fizike-spb.ru СПб: школьникам и студентам, с нуля и для олимпиад. Четкие объяснения, практика, реальные результаты.

order azithromycin without prescription – how to get tindamax without a prescription nebivolol online

Покупка дипломов ВУЗов по всей России и СНГ — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы даем гарантию, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 2311 клиентов воспользовались услугой — теперь ваша очередь.

На этой странице — ответим быстро, без лишних формальностей.

Мы предлагаем оформление дипломов ВУЗов в Москве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 1680 клиентов воспользовались услугой — теперь ваша очередь.

Пишите нам — ответим быстро, без лишних формальностей.

?Hola, seguidores del exito !

casino fuera de EspaГ±a sin verificaciГіn documental – https://www.casinosonlinefueradeespanol.xyz/ casinosonlinefueradeespanol.xyz

?Que disfrutes de asombrosas oportunidades inigualables !

Перевод документов https://medicaltranslate.ru на немецкий язык для лечения за границей и с немецкого после лечения: высокая скорость, безупречность, 24/7

Онлайн-тренинги https://communication-school.ru и курсы для личного роста, карьеры и новых навыков. Учитесь в удобное время из любой точки мира.

1С без сложностей https://1s-legko.ru объясняем простыми словами. Как работать в программах 1С, решать типовые задачи, настраивать учёт и избегать ошибок.

наркология запои номер наркологии

пансионат для пожилых адрес пансионат для пожилых

¡Saludos, seguidores del desafío !

Casino online extranjero con opciГіn de multicuenta – https://www.casinoextranjerosdeespana.es/# casinoextranjerosdeespana.es

¡Que experimentes maravillosas triunfos inolvidables !

Hello advocates of well-being !

Air Purifier for Smokers – Stylish and Functional – http://bestairpurifierforcigarettesmoke.guru/# bestairpurifierforcigarettesmoke

May you experience remarkable magnificent freshness !

order augmentin 375mg – https://atbioinfo.com/ buy generic ampicillin

вопрос юристу бесплатно бесплатная консультация адвоката без регистрации

типография печать спб типография

типография дешево типография санкт петербург

значки металлические купить значки металлические купить

значки металлические купить производство металлических значков

Покупка дипломов ВУЗов по всей России и СНГ — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы гарантируем, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 1376 клиентов воспользовались услугой — теперь ваша очередь.

Купить государственный диплом — ответим быстро, без лишних формальностей.

Оформиление дипломов ВУЗов по всей России и СНГ — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы даем гарантию, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 3905 клиентов воспользовались услугой — теперь ваша очередь.

Ознакомиться здесь — ответим быстро, без лишних формальностей.

Припомнилось даже, как нанимали этот таксомотор у «Метрополя», был еще при этом какой-то актер не актер… с патефоном в чемоданчике. Перевод паспорта: требования, стоимость и сроки – Бюро нотариальных переводов Словом, ад.

¡Hola, participantes del desafío !

Casino sin licencia espaГ±ola con pagos automГЎticos – https://casinosinlicenciaespana.xyz/# casinos no regulados

¡Que vivas increíbles jackpots impresionantes!

esomeprazole oral – anexamate buy esomeprazole 40mg sale

¡Saludos, descubridores de tesoros !

Casino sin licencia con pagos criptoautomГЎticos – https://audio-factory.es/# п»їcasinos sin licencia en espaГ±a

¡Que disfrutes de asombrosas movidas excepcionales !

coumadin 5mg pills – https://coumamide.com/ cost losartan 50mg

Срочный микрозайм https://truckers-money.ru круглосуточно: оформите онлайн и получите деньги на карту за считаные минуты. Без звонков, без залога, без лишних вопросов.

Discover Zabljak Savin Kuk, a picturesque corner of Montenegro. Skiing, hiking, panoramic views and the cleanest air. A great choice for a relaxing and active holiday.

AI generator character ai nsfw of the new generation: artificial intelligence turns text into stylish and realistic pictures and videos.

Услуги массаж ивантеевка — для здоровья, красоты и расслабления. Опытный специалист, удобное расположение, доступные цены.

Онлайн займы срочно https://moon-money.ru деньги за 5 минут на карту. Без справок, без звонков, без отказов. Простая заявка, моментальное решение и круглосуточная выдача.

AI generator nsfw ai video generator no limit of the new generation: artificial intelligence turns text into stylish and realistic pictures and videos.

Офисная мебель https://mkoffice.ru в Новосибирске: готовые комплекты и отдельные элементы. Широкий ассортимент, современные дизайны, доставка по городу.

ремонт стиральных машин индезит ремонт стиральных машин remont stiralok

UP&GO https://upandgo.ru путешествуй легко! Визы, авиабилеты и отели онлайн

Wow, wonderful blog structure! How lengthy have you ever been running a blog for? you made blogging glance easy. The overall glance of your site is great, as well as the content!

New AI generator free nsfw ai chat of the new generation: artificial intelligence turns text into stylish and realistic image and videos.

ремонт стиральных машин автомат ремонт холодильников и стиральных машин

Hindi News https://tfipost.in latest news from India and the world. Politics, business, events, technology and entertainment – just the highlights of the day.

Mountain Topper https://www.lnrprecision.com transceivers from the official supplier. Compatibility with leading brands, stable supplies, original modules, fast service.

Animal Feed https://pvslabs.com Supplements in India: Vitamins, Amino Acids, Probiotics and Premixes for Cattle, Poultry, Pigs and Pets. Increased Productivity and Health.

ремонт стиральной машины аристон ремонт стиральных машин частный мастер

¡Saludos, apostadores expertos !

Casino online sin verificaciГіn con ruleta europea – https://emausong.es/ casinos sin licencia espaГ±a

¡Que disfrutes de increíbles jugadas impresionantes !

Как забронировать и оплата бронирования на Booking из России, все способы оплаты отелей на Букинге для россиян, доступные в 2025 году смотрите в этом материале

buy mobic 15mg generic – https://moboxsin.com/ mobic 7.5mg oral

Greetings, explorers of unique punchlines !

Stupid jokes for adults with clever endings – https://jokesforadults.guru/# adult jokes

May you enjoy incredible memorable laughs !

I would like to thnkx for the efforts you have put in writing this blog. I am hoping the same high-grade blog post from you in the upcoming as well. In fact your creative writing abilities has inspired me to get my own blog now. Really the blogging is spreading its wings quickly. Your write up is a good example of it.

¡Saludos, participantes de retos emocionantes !

Casino online con bono de bienvenida inmediato – п»їhttps://bono.sindepositoespana.guru/# casinos con bono de bienvenida gratis

¡Que disfrutes de asombrosas momentos irrepetibles !

•очешь продать авто? телеграм канал продажа авто

deltasone 5mg generic – allergic reactions buy prednisone 10mg

Агентство контекстной рекламы https://kontekst-dlya-prodazh.ru настройка Яндекс.Директ и Google Ads под ключ. Привлекаем клиентов, оптимизируем бюджеты, повышаем конверсии.

Продвижение сайтов https://optimizaciya-i-prodvizhenie.ru в Google и Яндекс — только «белое» SEO. Улучшаем видимость, позиции и трафик. Аудит, стратегия, тексты, ссылки.

Шины и диски https://tssz.ru для любого авто: легковые, внедорожники, коммерческий транспорт. Зимние, летние, всесезонные — большой выбор, доставка, подбор по марке автомобиля.

Инженерная сантехника https://vodazone.ru в Москве — всё для отопления, водоснабжения и канализации. Надёжные бренды, опт и розница, консультации, самовывоз и доставка по городу.

LEBO Coffee https://lebo.ru натуральный кофе премиум-качества. Зерновой, молотый, в капсулах. Богатый вкус, аромат и свежая обжарка. Для дома, офиса и кофеен.

Gymnastics Hall of Fame https://usghof.org Biographies of Great Athletes Who Influenced the Sport. A detailed look at gymnastics equipment, from bars to mats.

создать сайт через нейросеть https://sozday-sayt-s-ai.ru

Woodworking and construction https://www.woodsurfer.com forum. Ask questions, share projects, read reviews of materials and tools. Help from practitioners and experienced craftsmen.

where to buy over the counter ed pills – ed pills no prescription buy ed pills

Но в «Колизее» порция судачков стоит тринадцать рублей пятнадцать копеек, а у нас – пять пятьдесят! Кроме того, в «Колизее» судачки третьедневочные, и, кроме того, еще у тебя нет гарантии, что ты не получишь в «Колизее» виноградной кистью по морде от первого попавшего молодого человека, ворвавшегося с Театрального проезда. Перевод паспорта РФ – Бюро нотариальных переводов Да нечего так на меня смотреть! Верно говорю! Все видел – и балкон, и пальмы.

здравоохранение больницы клиника диагностика

becici medical clinic clinic

purchase amoxil sale – buy cheap amoxil cheap amoxicillin generic

Психотерапевт Оренбург. Психолог онлайн 399 оценок

Виртуальные номера для Telegram basolinovoip.com создавайте аккаунты без SIM-карты. Регистрация за минуту, широкий выбор стран, удобная оплата. Идеально для анонимности, работы и продвижения.

Мы предлагаем оформление дипломов ВУЗов по всей Украине — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы даем гарантию, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 3430 клиентов воспользовались услугой — теперь ваша очередь.

Купить диплом специалиста недорого — ответим быстро, без лишних формальностей.

Odjeca i aksesoari za hotele hotelska posteljina cijene po sistemu kljuc u ruke: uniforme za sobarice, recepcionere, SPA ogrtaci, papuce, peskiri. Isporuke direktno od proizvodaca, stampa logotipa, jedinstveni stil.

Покупка дипломов ВУЗов по всей Украине — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы даем гарантию, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 4380 клиентов воспользовались услугой — теперь ваша очередь.

Купить диплом об образовании — ответим быстро, без лишних формальностей.

Мы предлагаем оформление дипломов ВУЗов В киеве — с печатями, подписями, приложением и возможностью архивной записи (по запросу).

Документ максимально приближен к оригиналу и проходит визуальную проверку.

Мы даем гарантию, что в случае проверки документа, подозрений не возникнет.

– Конфиденциально

– Доставка 3–7 дней

– Любая специальность

Уже более 2338 клиентов воспользовались услугой — теперь ваша очередь.

По ссылке — ответим быстро, без лишних формальностей.

суши барнаул каталог суши сайт барнаул

Хирургические услуги гинекологические операции: диагностика, операции, восстановление. Современная клиника, лицензированные специалисты, помощь туристам и резидентам.

Магазин брендовых кроссовок https://kicksvibe.ru Nike, Adidas, New Balance, Puma и другие. 100% оригинал, новые коллекции, быстрая доставка, удобная оплата. Стильно, комфортно, доступно!

заказать доставку суши барнаул https://sushi-barnaul.ru

Психотерапевт Белгород. Психолог онлайн 212 оценок

официальные казино топ интернет казино

Modern operations orthopedic surgery innovative technologies, precision and safety. Minimal risk, short recovery period. Plastic surgery, ophthalmology, dermatology, vascular procedures.

Профессиональное обучение плазмотерапии онлайн: PRP, Plasmolifting, протоколы и нюансы проведения процедур. Онлайн курс обучения плазмотерапии.

Онлайн-курсы обучение плазмотерапии: теория, видеоуроки, разбор техник. Обучение с нуля и для практикующих. Доступ к материалам 24/7, сертификат после прохождения, поддержка преподавателя.

fluconazole 100mg cost – site buy diflucan 200mg for sale

the best and interesting https://lusitanohorsefinder.com

interesting and new https://www.manaolahawaii.com

best site online https://www.colehardware.com

visit the site online https://www.saffireblue.ca

visit the site https://underatexassky.com

go to the site https://ibecensino.org.br

Профессиональная наркологическая клиника. Лечение зависимостей, капельницы, вывод из запоя, реабилитация. Анонимно, круглосуточно, с поддержкой врачей и психологов.

Removing remove clothes from pictures from images is an advanced tool for creative tasks. Neural networks, accurate generation, confidentiality. For legal and professional use only.

Then there’s Jenna, who started with minimal knowledge about finance. Through workshops and peer support in Briansclub.bz, she not only built her credit but also gained confidence in managing investments.

Рефрижераторные перевозки http://trud-ost.ru/?p=910109 по России и СНГ. Контроль температуры от -25°C до +25°C, современные машины, отслеживание груза.

buy escitalopram 20mg for sale – order escitalopram online cheap purchase lexapro online cheap

Выбирайте казино пиастрикс казино с оплатой через Piastrix — это удобно, безопасно и быстро! Топ-игры, лицензия, круглосуточная поддержка.

Ищете казино https://sbpcasino.ru? У нас — мгновенные переводы, слоты от топ-провайдеров, живые дилеры и быстрые выплаты. Безопасность, анонимность и мобильный доступ!

Хотите купить контрактный двигатель ДВС с гарантией? Б большой выбор моторов из Японии, Европы и Кореи. Проверенные ДВС с небольшим пробегом. Подбор по VIN, доставка по РФ, помощь с установкой.

Играйте в онлайн-покер https://droptopsite3.ru легальный с игроками со всего мира. МТТ, спины, VIP-программа, акции.

cenforce brand – buy cenforce 100mg without prescription cenforce 100mg usa

Элитная недвижимость https://real-estate-rich.ru в России и за границей — квартиры, виллы, пентхаусы, дома. Где купить, как оформить, во что вложиться.

Выбор застройщика https://spartak-realty.ru важный шаг при покупке квартиры. Расскажем, как проверить репутацию, сроки сдачи, проектную документацию и избежать проблем с новостройкой.

Смотреть фильмы kinobadi.mom и сериалы бесплатно, самый большой выбор фильмов и сериалов , многофункциональное сортировка, также у нас есть скачивание в mp4 формате

Недвижимость в Балашихе https://balashihabest.ru комфорт рядом с Москвой. Современные жилые комплексы, школы, парки, транспорт. Объекты в наличии, консультации, юридическое сопровождение сделки.

Поставка нерудных материалов https://sr-sb.ru песок, щебень, гравий, отсев. Прямые поставки на стройплощадки, карьерный материал, доставка самосвалами.

Лайфхаки для ремонта https://stroibud.ru квартиры и дома: нестандартные решения, экономия бюджета, удобные инструменты.

– тихо воскликнул Михаил Александрович. Цена как существенное условие договора подряда – Юрист Анна Дмитриевна Вот и лес отвалился, остался где-то сзади, и река ушла куда-то в сторону, навстречу грузовику сыпалась разная разность: какие-то заборы с караульными будками и штабеля дров, высоченные столбы и какие-то мачты, а на мачтах нанизанные катушки, груды щебня, земля, исполосованная каналами, – словом, чувствовалось, что вот-вот она, Москва, тут же, вон за поворотом, и сейчас навалится и охватит.

Женский журнал https://e-times.com.ua о красоте, моде, отношениях, здоровье и саморазвитии. Советы, тренды, рецепты, вдохновение на каждый день. Будь в курсе самого интересного!

Туристический портал https://atrium.if.ua всё для путешественников: путеводители, маршруты, советы, отели, билеты и отзывы. Откройте для себя новые направления с полезной информацией и лайфхаками.

Женский онлайн-журнал https://socvirus.com.ua мода, макияж, карьера, семья, тренды. Полезные статьи, интервью, обзоры и вдохновляющий контент для настоящих женщин.

Портал про ремонт https://prezent-house.com.ua полезные советы, инструкции, дизайн-идеи и лайфхаки. От черновой отделки до декора. Всё о ремонте квартир, домов и офисов — просто, понятно и по делу.

Всё о ремонте https://sevgr.org.ua на одном портале: полезные статьи, видеоуроки, проекты, ошибки и решения. Интерьерные идеи, советы мастеров, выбор стройматериалов.

Бюро дизайна https://sinega.com.ua интерьеров: функциональность, стиль и комфорт в каждой детали. Предлагаем современные решения, индивидуальный подход и поддержку на всех этапах проекта.

Портал про ремонт https://techproduct.com.ua для тех, кто строит, переделывает и обустраивает. Рекомендации, калькуляторы, фото до и после, инструкции по всем этапам ремонта.

Портал о строительстве https://bms-soft.com.ua от фундамента до кровли. Технологии, лайфхаки, выбор инструментов и материалов. Честные обзоры, проекты, сметы, помощь в выборе подрядчиков.

Всё о строительстве https://kinoranok.org.ua на одном портале: строительные технологии, интерьер, отделка, ландшафт. Советы экспертов, фото до и после, инструкции и реальные кейсы.

Ремонт и строительство https://mtbo.org.ua всё в одном месте. Сайт с советами, схемами, расчетами, обзорами и фотоидееями. Дом, дача, квартира — строй легко, качественно и с умом.

Сайт о ремонте https://sota-servis.com.ua и строительстве: от черновых работ до декора. Технологии, материалы, пошаговые инструкции и проекты.

Онлайн-журнал https://elektrod.com.ua о строительстве: технологии, законодательство, цены, инструменты, идеи. Для строителей, архитекторов, дизайнеров и владельцев недвижимости.

Полезный сайт https://quickstudio.com.ua о ремонте и строительстве: пошаговые гиды, проекты домов, выбор материалов, расчёты и лайфхаки. Для начинающих и профессионалов.

Журнал о строительстве https://tfsm.com.ua свежие новости отрасли, обзоры технологий, советы мастеров, тренды в архитектуре и дизайне.

Женский сайт https://7krasotok.com о моде, красоте, здоровье, отношениях и саморазвитии. Полезные советы, тренды, рецепты, лайфхаки и вдохновение для современных женщин.

Женские новости https://biglib.com.ua каждый день: мода, красота, здоровье, отношения, семья, карьера. Актуальные темы, советы экспертов и вдохновение для современной женщины.

Все главные женские https://pic.lg.ua новости в одном месте! Мировые и российские тренды, стиль жизни, психологические советы, звёзды, рецепты и лайфхаки.

Сайт для женщин https://angela.org.ua любого возраста — статьи о жизни, любви, стиле, здоровье и успехе. Полезно, искренне и с заботой.

Женский онлайн-журнал https://bestwoman.kyiv.ua для тех, кто ценит себя. Мода, уход, питание, мотивация и женская энергия в каждой статье.

Путеводитель по Греции https://cpcfpu.org.ua города, курорты, пляжи, достопримечательности и кухня. Советы туристам, маршруты, лайфхаки и лучшие места для отдыха.

Психотерапевт Челны. Психиатр онлайн 396 оценок

cialis contraindications – ciltad generic cialis usa

Портал о строительстве https://ateku.org.ua и ремонте: от фундамента до крыши. Пошаговые инструкции, лайфхаки, подбор материалов, идеи для интерьера.

Строительный портал https://avian.org.ua для профессионалов и новичков: проекты домов, выбор материалов, технологии, нормы и инструкции.

Туристический портал https://deluxtour.com.ua всё для путешествий: маршруты, путеводители, советы, бронирование отелей и билетов. Информация о странах, визах, отдыхе и достопримечательностях.

Открой мир https://hotel-atlantika.com.ua с нашим туристическим порталом! Подбор маршрутов, советы по странам, погода, валюта, безопасность, оформление виз.

Ваш онлайн-гид https://inhotel.com.ua в мире путешествий — туристический портал с проверенной информацией. Куда поехать, что посмотреть, где остановиться.

Строительный сайт https://diasoft.kiev.ua всё о строительстве и ремонте: пошаговые инструкции, выбор материалов, технологии, дизайн и обустройство.

Журнал о строительстве https://kennan.kiev.ua новости отрасли, технологии, советы, идеи и решения для дома, дачи и бизнеса. Фото-проекты, сметы, лайфхаки, рекомендации специалистов.

Сайт о строительстве https://domtut.com.ua и ремонте: практичные советы, инструкции, материалы, идеи для дома и дачи.

На строительном сайте https://eeu-a.kiev.ua вы найдёте всё: от выбора кирпича до дизайна спальни. Актуальная информация, фото-примеры, обзоры инструментов, консультации специалистов.

Строительный журнал https://inter-biz.com.ua актуальные статьи о стройке и ремонте, обзоры материалов и технологий, интервью с экспертами, проекты домов и советы мастеров.

buy facebook accounts find accounts for sale database of accounts for sale

Сайт о ремонте https://mia.km.ua и строительстве — полезные советы, инструкции, идеи, выбор материалов, технологии и дизайн интерьеров.

Сайт о ремонте https://rusproekt.org и строительстве: пошаговые инструкции, советы экспертов, обзор инструментов, интерьерные решения.

Всё для ремонта https://zip.org.ua и строительства — в одном месте! Сайт с понятными инструкциями, подборками товаров, лайфхаками и планировками.

Полезный сайт для ремонта https://rvps.kiev.ua и строительства: от черновых работ до отделки и декора. Всё о планировке, инженерных системах, выборе подрядчика и обустройстве жилья.

Автомобильный портал https://just-forum.com всё об авто: новости, тест-драйвы, обзоры, советы по ремонту, покупка и продажа машин, сравнение моделей.

Современный женский журнал https://superwoman.kyiv.ua стиль, успех, любовь, уют. Новости, идеи, лайфхаки и мотивация для тех, кто ценит себя и своё время.

Онлайн-портал https://spkokna.com.ua для современных родителей: беременность, роды, уход за малышами, школьные вопросы, советы педагогов и врачей.

Сайт для женщин https://ww2planes.com.ua идеи для красоты, здоровья, быта и отдыха. Тренды, рецепты, уход за собой, отношения и стиль.

Онлайн-журнал https://eternaltown.com.ua для женщин: будьте в курсе модных новинок, секретов красоты, рецептов и психологии.

Сайт для женщин https://womanfashion.com.ua которые ценят себя и своё время. Мода, косметика, вдохновение, мотивация, здоровье и гармония.

Современный авто портал https://simpsonsua.com.ua автомобили всех марок, тест-драйвы, лайфхаки, ТО, советы по покупке и продаже. Для тех, кто водит, ремонтирует и просто любит машины.

Женский онлайн-журнал https://abuki.info мода, красота, здоровье, психология, отношения и вдохновение. Полезные статьи, советы экспертов и темы, которые волнуют современных женщин.

Актуальные новости https://uapress.kyiv.ua на одном портале: события России и мира, интервью, обзоры, репортажи. Объективно, оперативно, профессионально. Будьте в курсе главного!

Онлайн авто портал https://sedan.kyiv.ua для автолюбителей и профессионалов. Новинки автоиндустрии, цены, характеристики, рейтинги, покупка и продажа автомобилей, автофорум.

Информационный портал https://mediateam.com.ua актуальные новости, аналитика, статьи, интервью и обзоры. Всё самое важное из мира политики, экономики, технологий, культуры и общества.

Новости Украины https://pto-kyiv.com.ua и мира сегодня: ключевые события, мнения экспертов, обзоры, происшествия, экономика, политика.

Современный мужской портал https://kompanion.com.ua полезный контент на каждый день. Новости, обзоры, мужской стиль, здоровье, авто, деньги, отношения и лайфхаки без воды.

Сайт для женщин https://storinka.com.ua всё о моде, красоте, здоровье, психологии, семье и саморазвитии. Полезные советы, вдохновляющие статьи и тренды для гармоничной жизни.

Следите за событиями https://kiev-pravda.kiev.ua дня на новостном портале: лента новостей, обзоры, прогнозы, мнения. Всё, что важно знать сегодня — быстро, чётко, объективно.

Новостной портал https://thingshistory.com для тех, кто хочет знать больше. Свежие публикации, горячие темы, авторские колонки, рейтинги и хроники. Удобный формат, только факты.

гастро бокс на подарок корпоратив Воронеж

месячные при спирали мирена https://spiral-mirena1.ru

ремонт стиральной машины candy мастер по ремонту стиральных машин

ремонт стиральных машин бош ремонт стиральных машин

ремонт замка стиральной машины ремонт стиральной машины candy

buy facebook ad accounts account trading platform buy and sell accounts

buy cialis on line – https://strongtadafl.com/# cialis patent expiration date

лазерной резки металла нужна лазерная резка металла

типография спб дешево типография

типография официальный сайт https://printexpressonline.ru

цифровая типография https://printrzn.ru

цифровая типография цифровая типография

лазерная эпиляция рук лазерная эпиляция цена

план отчета по практике отчеты по практике студентов

сделать реферат на заказ заказать реферат недорого

дипломная работа заказать https://diplomnazakaz-online.ru

написать диплом где купить дипломную работу

ranitidine buy online – ranitidine 150mg cost buy ranitidine 300mg generic

Hello stewards of pure serenity!

Small apartments benefit greatly from the best air purifiers for pets that are compact yet powerful. Pet owners say their air purifier for dog hair cut their vacuuming time in half and kept surfaces visibly cleaner. The best air purifier for pet hair should also be equipped with odor-absorbing technology for full impact.

A best home air purifier for pets can be the difference between constant sneezing and relief for allergy sufferers. Some users keep an air purifier for pet hair in their car to manage allergens during pet transport.air purifier for petsThose with multiple pets benefit greatly from dedicated air purifier for cat hair setups.

Best Home Air Purifier for Pets That Lasts Long – п»їhttps://www.youtube.com/watch?v=dPE254fvKgQ

May you enjoy remarkable unmatched clarity !

пригнать авто из японии пригнать авто

пригнать машину из кореи пригнать авто на заказ

пригнать авто из китая в россию пригнать машину под заказ

Как зарегистрировать ООО или ИП https://ifns150.ru в Санкт-Петербурге? Какие документы нужны для ликвидации фирмы? Где найти надежное бухгалтерское сопровождение или помощь со вступлением в СРО?

order viagra now – https://strongvpls.com/ buy viagra generic usa

Фурнитура MACO https://kupit-furnituru-maco.ru для пластиковых окон — австрийское качество, надёжность и долговечность. Петли, замки, микропроветривание, защита от взлома.

суши ролы доставка суши

Ремонт стиральных машин в Черкассах: https://postiralka.com.ua/ – каталог мастеров.

Sweet Bonanza resmi web sitesi simdi erisilebilir

Jogue Tigrinho, o jogo que esta bombando no Brasil

More articles like this would remedy the blogosphere richer. isotretinoin online

Актуальные тренды сегодня женские тренды: фото, видео и медиа. Всё о том, что популярно сегодня — в России и в мире. Мода, визуальные стили, digital-направления и соцсети. Следите за трендами и оставайтесь в курсе главных новинок каждого дня.

Нужен буст в игре? багги dune awakening легендарная броня, костюмы, скины и уникальные предметы. Всё для выживания на Арракисе!

More posts like this would persuade the online elbow-room more useful. amoxil para que sirve

Discover rafting tara montenegro rafting – the perfect holiday for nature lovers and extreme sports enthusiasts. The UNESCO-listed Tara Canyon will amaze you with its beauty and energy.

Гидроизоляция зданий https://gidrokva.ru и сооружений любой сложности. Фундаменты, подвалы, крыши, стены, инженерные конструкции.

Да, да, да, это было на даче! Еще, помнится, выли собаки от этого патефона. Что такое надзорное производство? – Юрист Анна Дмитриевна – И настанет царство истины? – Настанет, игемон, – убежденно ответил Иешуа.

This is the verified Grandpashabet Instagram – join now and play your favorite games

Таким он увидел себя в трюмо, а рядом с зеркалом увидел неизвестного человека, одетого в черное и в черном берете. Свистит, продувает, слышен шум улицы Ремонт окон в Москве В час жаркого весеннего заката на Патриарших прудах появилось двое граждан.

Заказать дипломную работу https://diplomikon.ru недорого и без стресса. Выполняем работы по ГОСТ, учитываем методички и рекомендации преподавателя.

Гидроизоляция зданий https://gidrokva.ru и сооружений любой сложности. Фундаменты, подвалы, крыши, стены, инженерные конструкции.

Заказать диплом https://diplomikon.ru быстро, надёжно, с гарантией! Напишем работу с нуля по вашим требованиям. Уникальность от 80%, оформление по ГОСТу.

Оформим реферат https://ref-na-zakaz.ru за 1 день! Напишем с нуля по вашим требованиям. Уникальность, грамотность, точное соответствие методичке.

Отчёты по практике https://gotov-otchet.ru на заказ и в готовом виде. Производственная, преддипломная, учебная.

Диплом под ключ https://diplomnazakaz-online.ru от выбора темы до презентации. Профессиональные авторы, оформление по ГОСТ, высокая уникальность.

Заказать диплом https://diplomikon.ru быстро, надёжно, с гарантией! Напишем работу с нуля по вашим требованиям. Уникальность от 80%, оформление по ГОСТу.

Оформим реферат https://ref-na-zakaz.ru за 1 день! Напишем с нуля по вашим требованиям. Уникальность, грамотность, точное соответствие методичке.

Отчёты по практике https://gotov-otchet.ru на заказ и в готовом виде. Производственная, преддипломная, учебная.

Заказать диплом https://diplomikon.ru быстро, надёжно, с гарантией! Напишем работу с нуля по вашим требованиям. Уникальность от 80%, оформление по ГОСТу.

Диплом под ключ https://diplomnazakaz-online.ru от выбора темы до презентации. Профессиональные авторы, оформление по ГОСТ, высокая уникальность.

Оформим реферат https://ref-na-zakaz.ru за 1 день! Напишем с нуля по вашим требованиям. Уникальность, грамотность, точное соответствие методичке.

Отчёты по практике https://gotov-otchet.ru на заказ и в готовом виде. Производственная, преддипломная, учебная.

Диплом под ключ https://diplomnazakaz-online.ru от выбора темы до презентации. Профессиональные авторы, оформление по ГОСТ, высокая уникальность.

More articles like this would frame the blogosphere richer. https://ursxdol.com/cialis-tadalafil-20/

Лучшие и актуальные промокоды на бесплатные ставки в популярных букмекерских конторах. Бонусы за регистрацию, фрибеты, удвоение депозита. Обновления каждый день.

Купить квартиру или дом черногория недвижимость у моря недорого Подберём квартиру, дом или виллу по вашему бюджету. Юридическая проверка, консультации, оформление ВНЖ.

Ваш безопасный портал bitcoin7.ru в мир криптовалют! Последние новости о криптовалютах Bitcoin, Ethereum, USDT, Ton, Solana. Актуальные курсы крипты и важные статьи о криптовалютах. Начните зарабатывать на цифровых активах вместе с нами

порно сквирт ебля шлюх

Магазин сантехники https://sanshop24.ru для дома и бизнеса. Качественная продукция от проверенных брендов: всё для ванной и кухни. Удобный каталог, акции, доставка, гарантия.

Ремонт офисов https://office-remont-spb.ru любой сложности: косметический, капитальный, под ключ. Современные материалы, строгое соблюдение сроков, опытные мастера.

Управляющая компания https://uk-nadeghda.ru обслуживание многоквартирных домов, текущий и капитальный ремонт, уборка, благоустройство, аварийная служба.

Всё о сантехнике https://santechcenter.ru советы по выбору, установке и ремонту. Обзоры смесителей, раковин, унитазов, душевых. Рейтинги, инструкции, лайфхаки и обзоры новинок рынка.

Ремонт и перекрой шуб https://remontmeha.ru обновим фасон, укоротим, заменим изношенные детали. Работа с норкой, мутоном, каракулем и др.

Оборудование для сантехники https://ventsan.ru вентиляции и климата — в одном месте. Котлы, трубы, вытяжки, кондиционеры, фитинги.

Скрытая мини-камера https://baisan.ru с Full HD, датчиком движения и автономной работой. Идеальна для наблюдения в квартире, офисе или автомобиле.

Продвижение сайтов https://team-black-top.ru под ключ: SEO-оптимизация, технический аудит, внутренняя и внешняя раскрутка. Повышаем видимость и продажи.

Всё о металлообработке https://j-metall.ru и металлах: технологии резки, сварки, литья, фрезеровки. Свойства металлов, советы для производства и хобби.

best esim buy esim for portugal

Ремонт квартир https://domov-remont.ru под ключ: от дизайн-проекта до финишной отделки. Честная смета, контроль этапов, гарантия до 5 лет. Работаем точно в срок.

ЖК «Атлант» https://atlantdom.ru современный жилой комплекс с развитой инфраструктурой, охраняемой территорией и парковкой. Просторные квартиры, благоустроенные дворы, удобное расположение.

This is the stripe of glad I have reading. https://prohnrg.com/

Услуги промышленных альпинистов https://trast-cleaning.ru высотные работы любой сложности, мойка фасадов, герметизация, монтаж, демонтаж.

Купить обои https://nash-dom71.ru для дома и офиса по доступным ценам. Виниловые, флизелиновые, текстильные, фотообои. Большой выбор, доставка, помощь в подборе.

esim germany buy esim with crypto

Служба ремонта https://rnd-master.ru все бытовые услуги в одном месте. Ремонт техники, сантехники, электрики, мелкий бытовой сервис. Быстро, качественно, с гарантией.

Монтаж систем отопления https://elitmaster1.ru в домах любой площади. Газовое, электрическое, комбинированное отопление. Подбор оборудования, разводка труб, запуск.

japan e sim e sim in india

Подбор вытяжки https://podberi-vytyazhku.ru по всем параметрам: площадь, фильтрация, уровень шума, тип управления. От эконом до премиум-сегмента.

Купить недвижимость https://karado.ru в Белгородской области просто: проверенные объекты, помощь в оформлении, консультации.

Продажа сплит-систем https://split-s.ru и кондиционеров для дома, офиса и коммерческих помещений. Широкий выбор моделей, установка под ключ, гарантия, доставка.

Стажировки для студентов https://turbo5.ru вузов: реальный опыт, развитие навыков, участие в проектах. Возможность начать карьеру в крупной компании.

Ремонт компьютеров https://aka-edd.ru и ноутбуков: блог с советами от мастеров. Разбор типичных поломок, пошаговые инструкции, обслуживание, апгрейд.

Блог о мелочах https://ugg-buy.ru которые делают жизнь лучше: организация быта, семейные советы, домашние рецепты, удобные привычки.

Ремонт и дизайн жилья https://giats.ru просто! Полезный блог с лайфхаками, трендами, советами по планировке, цвету, освещению и отделке.

Светодиодные светильники https://svetlotorg.ru для дома, офиса, улицы и промышленных объектов. Экономия электроэнергии, долгий срок службы, стильный дизайн.

Бурение скважин https://protokakburim.ru на воду для дома, дачи и бизнеса. Бесплатный выезд специалиста, честная смета, оборудование в наличии.

Медицинский блог https://msg4you.ru для всех, кто заботится о здоровье. Статьи от врачей, советы по профилактике, разбор симптомов и заболеваний, современные методы лечения.